39+ deducting mortgage interest from taxes

Web Compare TurboTax products. The amount you can deduct is limited but it can be.

Real Estate Tax Deductions You Didn T Know About

Ad Dont Leave Money On The Table with HR Block.

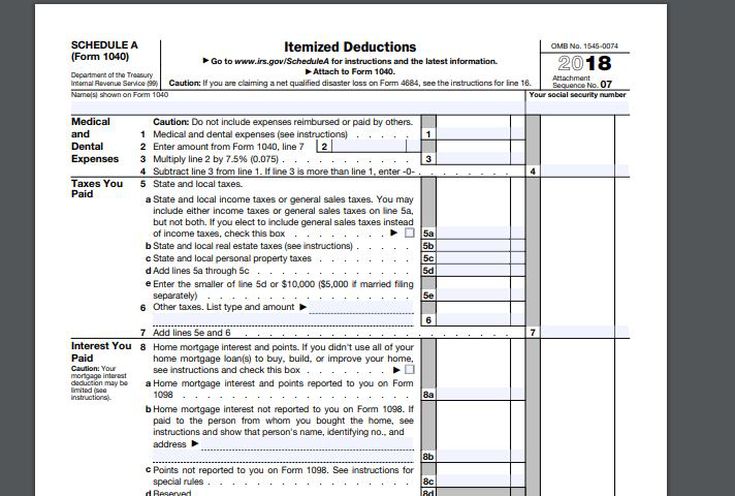

. And lets say you also paid. For tax years before 2018 the interest paid on up to 1 million of acquisition. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

However higher limitations 1 million 500000 if married. Web The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes. All online tax preparation software.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Get Your Max Refund Guaranteed. Learn More At AARP.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. So lets say that you paid 10000 in mortgage interest. Web 1 day agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

750000 if the loan was finalized. Web Up to 96 cash back You might qualify for real estate tax deductions if you pay mortgage interest in advance for a period that goes beyond the end of the tax year. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Web The interest deduction is an essential and beneficial tax provision for individuals who own homes. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

Deluxe to maximize tax deductions. Discover How HR Block Makes It Easier to File Your Way. If so you must.

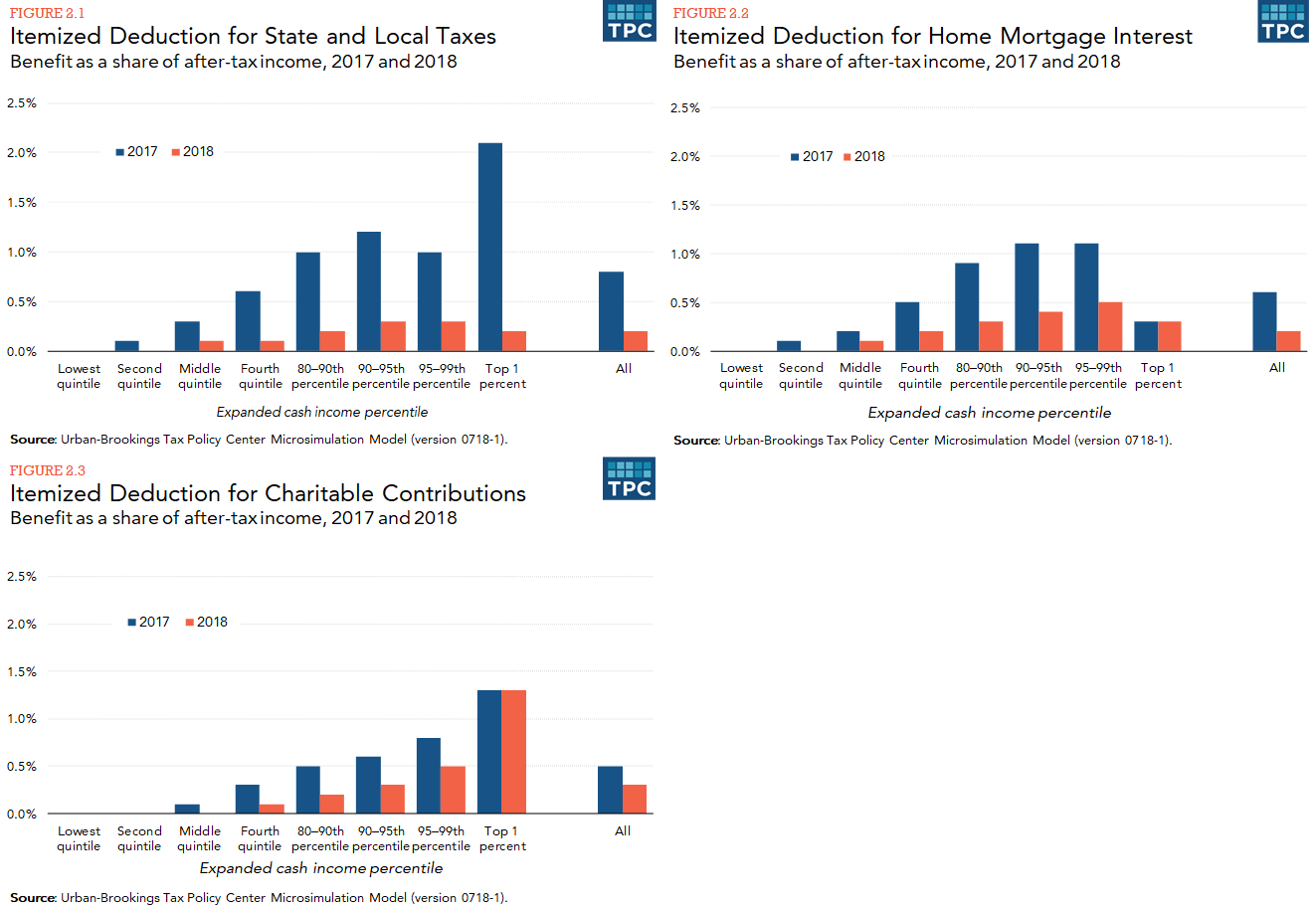

It allows taxpayers to lower their overall tax burden by. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Homeowners who bought houses before. Free Edition tax filing.

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. File Online or In-Person Today.

Premier investment rental property taxes. Web Is mortgage interest tax deductible. Web Most homeowners can deduct all of their mortgage interest.

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web The IRS places several limits on the amount of interest that you can deduct each year.

What Can Homeowners Deduct On Their Taxes 2023 Tax Season

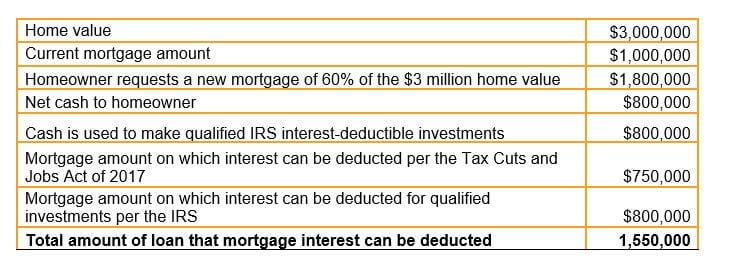

Borrow More Invest More Deduct More Cresset

Mortgage Interest Tax Deduction Doesn T Help Homeownership My Money Blog

7 Tax Deductions You Shouldn T Miss

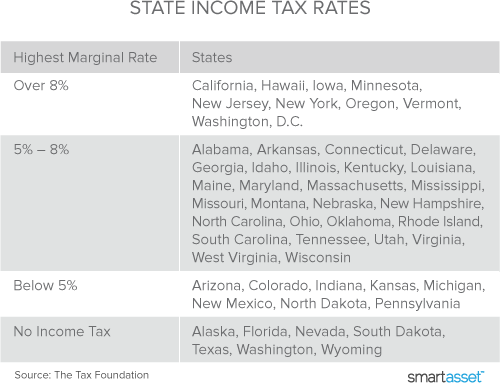

Mortgage Interest Tax Deduction Smartasset Com

:max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png)

Earnings Before Interest And Taxes Ebit How To Calculate With Example

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Amazon Com Egp Irs Approved 1098 Laser Set Mortgage Interest Tax Forms For 50 Recipients Tax Record Books Office Products

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Which States Benefit Most From The Home Mortgage Interest Deduction

What You Need To Know About The Mortgage Interest Deduction Fox Business

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

Key Tax Rules For Deducting Mortgage Interest

Effective Tax Rate Matters Evolved Tax Planning Southeast Mortgage

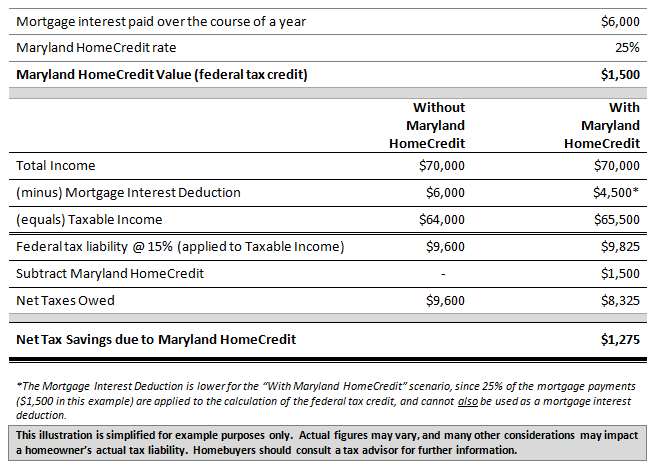

Maryland Homecredit Program Lender Information

Should You Pay Off Your Mortgage The New Tax Law Changes The Math Wsj